What Is a Successful Small Business?

Ask the average person what the purpose of a business is or how he or she would define a successful business, and the most likely response would be “one that makes a profit.” A more sophisticated reply might extend that to “one that makes an acceptable profit now and in the future.” Ask anyone in the finance department of a publicly held firm, and his or her answer would be “one that maximizes shareholder wealth.” The management guru Peter Drucker said that for businesses to succeed, they needed to create customers, while W. E. Deming, the quality guru, advocated that business success required “delighting” customers. No one can argue, specifically, with any of these definitions of small business success, but they miss an important element of the definition of success for the small business owner: to be free and independent.

Many people have studied whether there is any significant difference between the small business owner and the entrepreneur. Some entrepreneurs place more emphasis on growth in their definition of success.William Dunkelberg and A. C. Cooper. “Entrepreneurial Typologies: An Empirical Study,” Frontiers of Entrepreneurial Research, ed. K. H. Vesper (Wellesley, MA: Babson College, Centre for Entrepreneurial Studies, 1982), 1–15. However, it is clear that entrepreneurs and small business owners define much of their personal and their firm’s success in the context of providing them with independence. For many small business owners, being in charge of their own life is the prime motivator: a “fervently guarded sense of independence,” and money is seen as a beneficial by-product.“Report on the Commission or Enquiry on Small Firms,” Bolton Report, vol. 339 (London: HMSO, February 1973), 156–73.,Paul Burns and Christopher Dewhurst, Small Business and Entrepreneurship, 2nd ed. (Basingstoke, UK: Macmillan, 1996), 17.,Graham Beaver, Business, Entrepreneurship and Enterprise Development (Englewood Cliffs, NJ: Prentice Hall, 2002), 33.Oftentimes, financial performance is seen as an important measure of success. However, small businesses are reluctant to report their financial information, so this will always be an imperfect and incomplete measure of success.Terry L. Besser, “Community Involvement and the Perception of Success Among Small Business Operators in Small Towns,” Journal of Small Business Management37, no 4 (1999): 16.

Three types of small business operators can be identified based on what they see as constituting success:

- An artisan whose intrinsic satisfaction comes from performing the business activity

- The entrepreneur who seeks growth

- The owner who seeks independenceM. K. J. Stanworth and J. Curran, “Growth and the Small Firm: An Alternative View,” Journal of Management Studies 13, no. 2 (1976): 95–111.

Failure Rates for Small Business

When discussing failure rates in small business, there is only one appropriate word: confusion. There are wildly different values, from 90 percent to 1 percent, with a wide range of values in between.Roger Dickinson, “Business Failure Rate,” American Journal of Small Business 6, no. 2 (1981): 17–25.Obviously, there is a problem with these results, or some factor is missing. One factor that would explain this discrepancy is the different definitions of the term failure. A second factor is that of timeline. When will a firm fail after it starts operation?

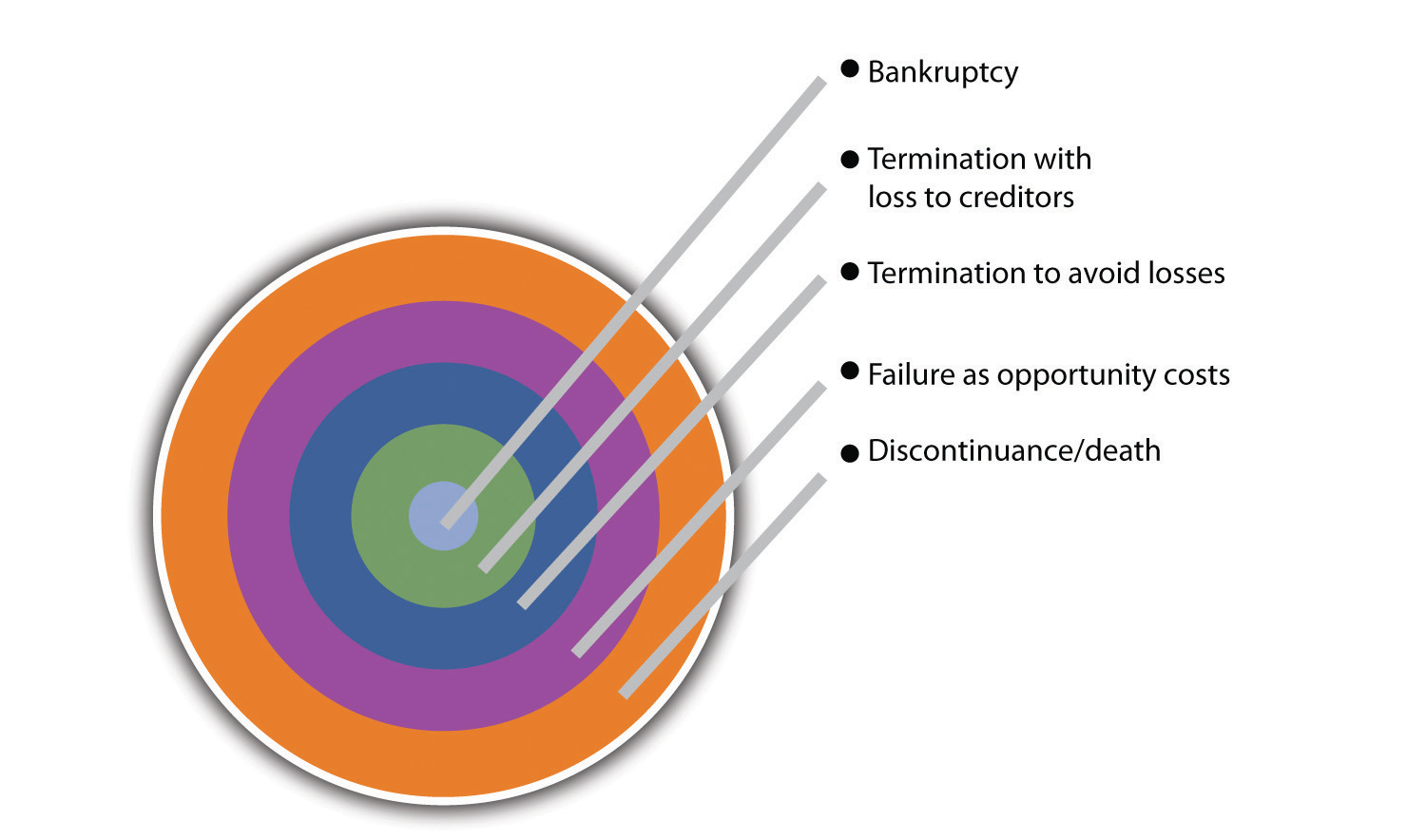

The term failure can have several meanings.A. B. Cochran, “Small Business Failure Rates: A Review of the Literature,” Journal of Small Business Management 19, no. 4, (1981): 50–59. Small-business failure is often measured by the cessation of a firm’s operation, but this can be brought about by several things:

- An owner can die or simply choose to discontinue operations.

- The owner may recognize that the business is not generating sufficient return to warrant the effort that is being put into it. This is sometimes referred to as the failure of opportunity cost.

- A firm that is losing money may be terminated to avoid losses to its creditors.

- There can be losses to creditors that bring about cessations of the firm’s operations.

- The firm can experience bankruptcy. Bankruptcy is probably what most people think of when they hear the term business failure. However, the evidence indicates that bankruptcies constitute only a minor reason for failure.

Failure can therefore be thought of in terms of a cascading series of outcomes (see Figure 1.1 “Types of Business Failures”). There are even times when small business owners involved in a closure consider the firm successful at its closing.Don Bradley and Chris Cowdery, “Small Business: Causes of Bankruptcy,” July 26, 2004, accessed October 7, 2011, www.sbaer.uca.edu/research/asbe/2004_fall/16.pdf. Then there is the complication of considering the industry of the small business when examining failure and bankruptcy. The rates of failure can vary considerably across different industries; in the fourth quarter of 2009, the failure rates for service firms were half that of transportation firms.“Equifax Study Shows the Ups and Downs of Commercial Credit Trends,” Equifax, 2010, accessed October 7, 2011, www.equifax.com/PR/pdfs/CommercialFactSheetFN3810.pdf.

Figure 1.1 Types of Business Failures

The second issue associated with small business failure is a consideration of the time horizon. Again, there are wildly different viewpoints. The Dan River Small Business Development Center presented data that indicated that 95 percent of small businesses fail within five years.Don Bradley and Chris Cowdery, “Small Business: Causes of Bankruptcy,” July 26, 2004, accessed October 7, 2011, www.sbaer.uca.edu/research/asbe/2004_fall/16.pdf. Dun and Bradstreet reported that companies with fewer than twenty employees have only a 37 percent chance of surviving four years, but only 10 percent will go bankrupt.Don Bradley and Chris Cowdery, “Small Business: Causes of Bankruptcy,” July 26, 2004, accessed October 7, 2011, www.sbaer.uca.edu/research/asbe/2004_fall/16.pdf. The US Bureau of Labor Statistics indicated that 66 percent of new establishments survive for two years, and that number drops to 44 percent two years later.Anita Campbell, “Business Failure Rates Is Highest in First Two Years,” Small Business Trends, July 7, 2005, accessed October 7, 2011, smallbiztrends.com/2005/07/business-failure-rates-highest-in.html. It appears that the longer you survive, the higher the probability of your continued existence. This makes sense, but it is no guarantee. Any business can fail after many years of success.

Why Do Small Businesses Fail?

There is no more puzzling or better studied issue in the field of small business than what causes them to fail. Given the critical role of small businesses in the US economy, the economic consequences of failure can be significant. Yet there is no definitive answer to the question.

Three broad categories of causes of failure have been identified: managerial inadequacy, financial inadequacy, and external factors. The first cause, managerial inadequacy, is the most frequently mentioned reason for firm failure.T. C. Carbone, “The Challenges of Small Business Management,” Management World 9, no. 10 (1980): 36. Unfortunately, it is an all-inclusive explanation, much like explaining that all plane crashes are due to pilot failure. Over thirty years ago, it was observed that “while everyone agrees that bad management is the prime cause of failure, no one agrees what ‘bad management’ means nor how it can be recognized except that the company has collapsed—then everyone agrees that how badly managed it was.”John Argenti, Corporate Collapse: The Causes and Symptoms (New York: McGraw-Hill, 1976), 45. This observation remains true today.

The second most common explanation cites financial inadequacy, or a lack of financial strength in a firm. A third set of explanations center on environmental or external factors, such as a significant decline in the economy.

Because it is important that small firms succeed, not fail, each factor will be discussed in detail. However, these factors are not independent elements distinct from each other. A declining economy will depress a firm’s sales, which negatively affects a firm’s cash flow. An owner who lacks the knowledge and experience to manage this cash flow problem will see his or her firm fail.

Managerial inadequacy is generally perceived as the major cause of small business failure. Unfortunately, this term encompasses a very broad set of issues. It has been estimated that two thirds of small business failures are due to the incompetence of the owner-manager.Graham Beaver, “Small Business: Success and Failure,” Strategic Change 12, no. 3 (2003): 115–22. The identified problems cover behavioral issues, a lack of business skills, a lack of specific technical skills, and marketing myopia. Specifying every limitation of these owners would be prohibitive. However, some limitations are mentioned with remarkable consistency. Having poor communication skills, with employees and/or customers, appears to be a marker for failure.Sharon Nelton, “Ten Key Threats to Success,” Nation’s Business 80, no. 6 (1992): 18–24. The inability to listen to criticism or divergent views is a marker for failure, as is the inability to be flexible in one’s thinking.Robert N. Steck, “Why New Businesses Fail,” Dun and Bradstreet Reports 33, no. 6 (1985): 34–38.

Ask many small business owners where their strategic plans exist, and they may point to their foreheads. The failure to conduct formal planning may be the most frequently mentioned item with respect to small business failure. Given the relative lack of resources, it is not surprising that small firms tend to opt for intuitive approaches to planning.G. E. Tibbits, “Small Business Management: A Normative Approach,” in Small Business Perspectives, ed. Peter Gorb, Phillip Dowell, and Peter Wilson (London: Armstrong Publishing, 1981), 105.,Jim Brown, Business Growth Action Kit(London: Kogan Page, 1995), 26. Formal approaches to planning are seen as a waste of time,Christopher Orpen, “Strategic Planning, Scanning Activities and the Financial Performance of Small Firms,” Journal of Strategic Change 3, no. 1 (1994): 45–55. or they are seen as too theoretical.Sandra Hogarth-Scott, Kathryn Watson, and Nicholas Wilson, “Do Small Business Have to Practice Marketing to Survive and Grow?,” Marketing Intelligence and Planning 14, no. 1 (1995): 6–18. The end result is that many small business owners fail to conduct formal strategic planning in a meaningful way.Isaiah A. Litvak and Christopher J. Maule, “Entrepreneurial Success or Failure—Ten Years Later,” Business Quarterly 45, no. 4 (1980): 65.,Hans J. Pleitner, “Strategic Behavior in Small and Medium-Sized Firms: Preliminary Considerations,” Journal of Small Business Management 27, no. 4 (1989): 70–75. In fact, many fail to conduct any planning;Richard Monk, “Why Small Businesses Fail,” CMA Management 74, no. 6 (2000): 12.,Anonymous, “Top-10 Deadly Mistakes for Small Business,” Green Industry Pro 19, no. 7 (2007): 58. others may fail to conduct operational planning, such as marketing strategies.Rubik Atamian and Neal R. VanZante, “Continuing Education: A Vital Ingredient of the ‘Success Plan’ for Business,” Journal of Business and Economic Research 8, no. 3 (2010): 37–42. The evidence appears to clearly indicate that a small firm that wishes to be successful needs to not only develop an initial strategic plan but also conduct an ongoing process of strategic renewal through planning.

Many managers do not have the ability to correctly select staff or manage them.T. Carbone, “Four Common Management Failures—And How to Avoid Them,” Management World 10, no. 8 (1981): 38–39. Other managerial failings appear to be in limitations in the functional area of marketing. Failing firms tend to ignore the changing demands of their customers, something that can have devastating effects.Anonymous, “Top-10 Deadly Mistakes for Small Business,” Green Industry Pro 19, no. 7 (2007): 58. The failure to understand what customers value and being able to adapt to changing customer needs often leads to business failure.Rubik Atamian and Neal R. VanZante, “Continuing Education: A Vital Ingredient of the ‘Success Plan’ for Business,” Journal of Business and Economic Research 8, no. 3 (2010): 37–42.

The second major cause of small business failure is finance. Financial problems fall into three categories: start-up, cash flow, and financial management. When a firm begins operation (start-up), it will require capital. Unfortunately, many small business owners initially underestimate the amount of capital that should be available for operations.Howard Upton, “Management Mistakes in a New Business,” National Petroleum News 84, no. 10 (1992): 50. This may explain why most small firms that fail do so within the first few years of their creation. The failure to start with sufficient capital can be attributed to the inability of the owner to acquire the needed capital. It can also be due to the owner’s failure to sufficiently plan for his or her capital needs. Here we see the possible interactions among the major causes of firm failure. Cash-flow management has been identified as a prime cause for failure.Rubik Atamian and Neal R. VanZante, “Continuing Education: A Vital Ingredient of the ‘Success Plan’ for Business,” Journal of Business and Economic Research 8, no. 3 (2010): 37–42.,Arthur R. DeThomas and William B. Fredenberger, “Accounting Needs of Very Small Business,” The CPA Journal 55, no. 10 (1985): 14–20. Good cash-flow management is essential for the survival of any firm, but small firms in particular must pay close attention to this process. Small businesses must develop and maintain effective financial controls, such as credit controls.Roger Brown, “Keeping Control of Your Credit,” Motor Transportation, April 2009, 8. For very small businesses, this translates into having an owner who has at least a fundamental familiarity with accounting and finance.Arthur R. DeThomas and William B. Fredenberger, “Accounting Needs of Very Small Business,” The CPA Journal 55, no. 10 (1985): 14–20. In addition, the small firm will need either an in-house or an outsourced accountant.Hugh M. O’Neill and Jacob Duker, “Survival and Failure in Small Business,” Journal of Small Business Management 24, no. 1 (1986): 30–37. Unfortunately, many owners fail to fully use their accountants’ advice to manage their businesses.Arthur R. DeThomas and William B. Fredenberger, “Accounting Needs of Very Small Business,” The CPA Journal 55, no. 10 (1985): 14–20.

The last major factor identified with the failure of small businesses is the external environment. There is a potentially infinite list of causes, but the economic environment tends to be most prominent. Here again, however, confusing appears to describe the list. Some argue that economic conditions contribute to between 30 percent and 50 percent of small business failures, in direct contradiction to the belief that managerial incompetence is the major cause.Jim Everett and John Watson, “Small Business Failures and External Risk Factors,” Small Business Economics 11, no. 4 (1998): 371–90.Two economic measures appear to affect failure rates: interest rates, which appear to be tied to bankruptcies, and the unemployment rate, which appears to be tied to discontinuance.Jim Everett and John Watson, “Small Business Failures and External Risk Factors,” Small Business Economics 11, no. 4 (1998): 371–90. The potential impact of these external economic variables might be that small business owners need to be either planners to cover potential contingencies or lucky.

Even given the confusing and sometimes conflicting results with respect to failure in small businesses, some common themes can be identified. The reasons for failure fall into three broad categories: managerial inadequacy, finance, and environmental. They, in turn, have some consistently mentioned factors (see Table 1.5 “Reasons for Small Business Failure”). These factors should be viewed as warning signs—danger areas that need to be avoided if you wish to survive. Although small business owners cannot directly affect environmental conditions, they can recognize the potential problems that they might bring. This text will provide guidance on how the small business owner can minimize these threats through proactive leadership.

Table 1.5 Reasons for Small Business Failure

| Managerial Inadequacy | Financial Inadequacy | External Factors |

|---|---|---|

|

|

|

Ultimately, business failure will be a company-specific combination of factors. Monitor101, a company that developed an Internet information monitoring product for institutional investors in 2005, failed badly. One of the cofounders identified the following seven mistakes that were made, most of which can be linked to managerial inadequacy:Roger Ehrenberg, “Monitor 110: A Post Mortem—Turning Failure into Learning,” Making It!, August 27, 2009, accessed June 1, 2012, http://www.makingittv.com/Small-Business-Entrepreneur-Story-Failure.htm.

- The lack of a single “the buck stops here” leader until too late in the game

- No separation between the technology organization and the product organization

- Too much public relations, too early

- Too much money

- Not close enough to the customer

- Slowness to adapt to market reality

- Disagreement on strategy within the company and with the board

“Entrepreneurs Turn Business Failure into Success”

Bloomberg Businessweek‘s 2008 cover story highlights owners who turn business failure into success.

http://www.businessweek.com/magazine/content/08_70/s0810040731198.htm

KEY TAKEAWAYS

- There is no universal definition for small business success. However, many small business owners see success as their own independence.

- The failure rates for small businesses are wide ranging. There is no consensus.

- Three broad categories of factors are thought to contribute to small business failure: managerial inadequacy, financial inadequacy, and external forces, most notably the economic environment.

EXERCISES

- Starting a business can be a daunting task. It can be made even more daunting if the type of business you choose is particularly risky. Go to www.forbes.com/2007/01/18/fairisaac-nordstrom-verizon-ent-fin-cx_mf_0118risky_slide.html?thisSpeed=undefined, where the ten riskiest businesses are identified. Select any two of these businesses and address why you think they are risky.

- Amy Knaup is the author of a 2005 study “Survival and Longevity in the Business Employment Dynamics Data” (see www.bls.gov/opub/mlr/2005/05/ressum.pdf). The article points to different survival rates for ten different industries. Discuss why there are significant differences in the survival rates among these industries.

1.3 Evolution

LEARNING OBJECTIVES

- Define the five stages of small business growth.

- Identify the stages of the organizational life cycle.

- Characterize the industry life cycle and its impact on small business.

Small businesses come in all shapes and sizes. One thing that they all share, however, is experience with common problems that arise at similar stages in their growth and organizational evolution. Predictable patterns can be seen. These patterns “tend to be sequential, occur as a hierarchical progression that is not easily reversed, and involve a broad range of organizational activities and structures.”“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html. The industry life cycle adds further complications. The success of any small business will depend on its ability to adapt to evolutionary changes, each of which will be characterized by different requirements, opportunities, challenges, risks, and internal and external threats. The decisions that need to be made and the priorities that are established will differ through this evolution.

Stages of Growth

Understanding the small business growth stages can be invaluable as a framework for anticipating resource needs and problems, assessing risk, and formulating business strategies (e.g., evaluating and responding to the impact of a new tax). However, the growth stages will not be applicable to all small businesses because not all small businesses will be looking to grow. Business success is commonly associated with growth and financial performance, but these are not necessarily synonymous—especially for small businesses. People become business owners for different reasons, so judgments about the success of their businesses may be related to any of those reasons.B. Kotey and G. G. Meredith, “Relationships among Owner/Manager Personal Values, Business Strategies, and Enterprise Performance,” Journal of Small Business Management 35, no. 2 (1997): 37–65. A classic study by Churchill and Lewis identified five stages of small business growth: existence, survival, success, take-off, and resource maturity.Neil C. Churchill and Virginia L. Lewis, “The Five Stages of Small Business Growth,” Harvard Business Review 61, no. 3 (1983): 30–44, 48–50. Each stage has its own challenges.

- Stage I: Existence.Neil C. Churchill and Virginia L. Lewis, “The Five Stages of Small Business Growth,” Harvard Business Review 61, no. 3 (1983): 30–44, 48–50. This is the beginning. The business is up and running. The primary problems will be obtaining customers and establishing a customer base, producing products or services, and tracking and conserving cash flow.Darrell Zahorsky, “Find Your Business Life Cycle,” accessed October 7, 2011, sbinformation.about.com/cs/marketing/a/a040603.htm. The organization is simple, with the owner doing everything, including directly supervising a small number of subordinates. Systems and formal planning do not exist. The company strategy? Staying alive. The companies that stay in business move to Stage II.

- Stage II: Survival.Neil C. Churchill and Virginia L. Lewis, “The Five Stages of Small Business Growth,” Harvard Business Review 61, no. 3 (1983): 30–44, 48–50. The business is now a viable operation. There are enough customers, and they are being satisfied well enough for them to stay with the business. The company’s focal point shifts to the relationship between revenues and expenses. Owners will be concerned with (1) whether they can generate enough cash in the short run to break even and cover the repair/replacement of basic assets and (2) whether they can get enough cash flow to stay in business and finance growth to earn an economic return on assets and labor. The organizational structure remains simple. Little systems development is evident, cash forecasting is the focus of formal planning, and the owner still runs everything.

- Stage III: Success.Neil C. Churchill and Virginia L. Lewis, “The Five Stages of Small Business Growth,” Harvard Business Review 61, no. 3 (1983): 30–44, 48–50. The business is now economically healthy, and the owners are considering whether to leverage the company for growth or consider the company as a means of support for them as they disengage from the company.Shivonne Byrne, “Empowering Small Business,” Innuity, June 25, 2007, accessed October 7, 2011, innuity.typepad.com/innuity_empowers_small_bu/2007/06/five -stages-of-.html. There are two tracks within the success stage. The first track is the success-growth substage, where the small business owner pulls all the company resources together and risks them all in financing growth. Systems are installed with forthcoming needs in mind. Operational planning focuses on budgets. Strategic planning is extensive, and the owner is deeply involved. The management style is functional, but the owner is active in all phases of the company’s business. The second track is the success-disengagement substage, where managers take over the owner’s operational duties, and the strategy focuses on maintaining the status quo. Cash is plentiful, so the company should be able to maintain itself indefinitely, barring external environmental changes. The owners benefit indefinitely from the positive cash flow or prepare for a sale or a merger. The first professional managers are hired, and basic financial, marketing, and production systems are in place.

- Stage IV: Take-off.Neil C. Churchill and Virginia L. Lewis, “The Five Stages of Small Business Growth,” Harvard Business Review 61, no. 3 (1983): 30–44, 48–50. This is a critical time in a company’s life. The business is becoming increasingly complex. The owners must decide how to grow rapidly and how to finance that growth. There are two key questions: (1) Can the owner delegate responsibility to others to improve managerial effectiveness? (2) Will there be enough cash to satisfy the demands of growth? The organization is decentralized and may have some divisions in place. Both operational planning and strategic planning are being conducted and involve specific managers. If the owner rises to the challenges of growth, it can become a very successful big business. If not, it can usually be sold at a profit.

- Stage V: Resource Maturity.Neil C. Churchill and Virginia L. Lewis, “The Five Stages of Small Business Growth,” Harvard Business Review 61, no. 3 (1983): 30–44, 48–50. The company has arrived. It has the staff and financial resources to engage in detailed operational and strategic planning. The management structure is decentralized, with experienced senior staff, and all necessary systems are in place. The owner and the business have separated both financially and operationally. The concerns at this stage are to (1) consolidate and control the financial gains that have been brought on by the rapid growth and (2) retain the advantage of a small size (e.g., response flexibility and the entrepreneurial spirit). If the entrepreneurial spirit can be maintained, there is a strong probability of continued growth and success. If not, the company may find itself in a state of ossification. This occurs when there is a lack of innovation and risk aversion that, in turn, will contribute to stalled or halted growth. These are common traits in large corporations.

Organizational Life Cycle

Superimposed on the stages of small business growth is the organizational life cycle (OLC), a concept that specifically acknowledges that organizations go through different life cycles, just like people do.Carter McNamara, “Basic Overview of Organizational Life Cycles,” accessed October 7, 2011, http://managementhelp.org/organizations/life-cycles.htm. “They are born (established or formed), they grow and develop, they reach maturity, they begin to decline and age, and finally, in many cases, they die.”“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html. The changes that occur in organizations have a predictable pattern,Robert E. Quinn and Kim Cameron, “Organizational Life Cycles and Shifting Criteria of Effectiveness: Some Preliminary Evidence,” Management Science 29, no. 1 (1983): 33–51. and this predictability will be very helpful in formulating the objectives and strategies of a small business, altering managerial processes, identifying the sources of risk, and managing organizational change.“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html.,Yash P. Gupta and David C. W. Chin, “Organizational Life Cycle: A Review and Proposed Directions for Research,” The Mid-Atlantic Journal of Business 30, no. 3 (December 1994): 269–94. Because not all small businesses are looking to grow, however, it is likely that many small companies will retain simple organizational structures.

For those small businesses that are looking to grow, the move from one OLC stage to another occurs because the fit between the organization and its environment is so inadequate that either the organization’s efficiency and/or effectiveness is seriously impaired or the organization’s very survival is threatened. Pressure will come from changes in the nature and number of requirements, opportunities, and threats.“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html.

Four OLC stages can be observed: birth, youth, midlife, and maturity.Carter McNamara, “Basic Overview of Organizational Life Cycles,” accessed October 7, 2011, http://managementhelp.org/organizations/life-cycles.htm. In the birth stage, a small business will have a very simple organizational structure, one in which the owner does everything. There are few, if any, subordinates. As the business moves through youth and midlife, more sophisticated structures will be adopted, and authority will be decentralized to middle- and lower-level managers. At maturity, firms will demonstrate significantly more concern for internal efficiency, install more control mechanisms and processes, and become very bureaucratic. There are other features as well that characterize the movement of an organization from birth to maturity, which are summarized in Table 1.6 “Organizational Life Cycle Features”.

Table 1.6 Organizational Life Cycle Features

| Feature | Birth Cycle | Youth Cycle | Midlife Cycle | Maturity Cycle |

|---|---|---|---|---|

| Size | Small | Medium | Large | Very large |

| Bureaucratic | Nonbureaucratic | Prebureaucratic | Bureaucratic | Very bureaucratic |

| Division of labor | Overlapping tasks | Some departments | Many departments | Extensive, with small jobs and many descriptions |

| Centralization | One-person rule | Two leaders rule | Two department heads | Top-management heavy |

| Formalization | No written rules | Few rules | Policy and procedure manuals | Extensive |

| Administrative intensity | Secretary, no professional staff | Increasing clerical and maintenance | Increasing professional and staff support | Large-multiple departments |

| Internal systems | Nonexistent | Crude budget and information | Control systems in place: budget, performance, reports, etc. | Extensive planning, financial, and personnel added |

| Lateral teams, task forces for coordination | None | Top leaders only | Some use of integrators and task | Frequent at lower levels to break down bureaucracy |

Source: Richard L. Daft, Organizational Theory and Design (St. Paul, MN: West Publishing, 1992), as cited in Carter McNamara, “Basic Overview of Organizational Life Cycles,” accessed October 7, 2011, http://managementhelp.org/organizations/life-cycles.htm.

A small business will always be somewhere on the OLC continuum. Business success will often be based on recognizing where the business is situated along that continuum and adopting strategies best suited to that place in the cycle.

Industry Life Cycle

The industry life cycle (ILC) is another dimension of small business evolution, which needs to be understood and assessed in concert with the stages of small business growth and the OLC. All small businesses compete in an industry, and that industry will experience a life cycle just as products and organizations do. Although there may be overlap in the names of the ILC stages, the meaning and implications of each stage are different.

The industry life cycle refers to the continuum along which an industry is born, grows, matures, and eventually experiences decline and then dies. Although the pattern is predictable, the duration of each stage in the cycle is not. The stages are the same for all industries, but every industry will experience the stages differently. The stages will last longer for some and pass quickly for others; even within the same industry various small businesses may find themselves at different life cycle stages.“Industry Life Cycle,” Inc., 2010, accessed June 1, 2012, www.inc.com/encyclopedia/industry-life-cycle.html. However, no matter where a small business finds itself along the ILC continuum, the strategic planning of that business will be influenced in important ways.

According to one study, the ILC, charted on the basis of the growth of an industry’s sales over time, can be observed as having four stages: introduction, growth, maturity, and decline.“Industry Life Cycle,” Inc., 2010, accessed June 1, 2012, www.inc.com/encyclopedia/industry-life-cycle.html. The introduction stage“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html. finds the industry in its infancy. Although it is possible for a small business to be alone in the industry as a result of having developed and introduced something new to the marketplace, this is not the usual situation. The business strategy will focus on stressing the uniqueness of the product or the service to a small group of customers, commonly referred to as innovators or early adopters. A significant amount of capital is required. Profits are usually negative for both the firm and the industry.

The growth stage“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html. is the second ILC stage. This stage also requires a significant amount of capital, but increasing product standardization may lead to economies of scale that will, in turn, increase profitability. The strategic focus is product differentiation, with an increased focus on responding to customer needs and interests. Intense competition will result as more new competitors join the industry, but many firms will be profitable. The duration of the growth stage will be industry dependent.

The maturity stage“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html. will see some competition from late entrants that will try to take market share away from existing companies. This means that the marketing effort must continue to focus on product or service differentiation. There will be fewer firms in mature industries, so those that survive will be larger and more dominant. Many small businesses may move into the ranks of midsize or big businesses.

The decline stage“Organizational Life Cycle,” Inc., 2010, accessed October 7, 2011, www.inc.com/encyclopedia/organizational-life-cycle.html. occurs in most industries. It is typically triggered by a product or service innovation that renders the industry obsolete. Sales will suffer, and the business goes into decline. Some companies will leave the industry, but others will remain to compete in the smaller market. The smaller businesses may be more agile for competing in a declining industry, but they will need to carefully formulate their business strategies to remain viable.

KEY TAKEAWAYS

- Small-business management should consider the growth stages, the OLC, and the ILC in its planning.

- There are five stages of small business growth: existence, survival, success, take-off, and resource maturity. The success stage includes two substages, growth and disengagement. Ossification may result if a mature small business loses its entrepreneurial spirit and becomes more risk averse.

- Some small businesses may not be looking to grow, so they may remain in the survival stage.

- The OLC refers to the four stages of development that organizations go through: birth, youth, midlife, and maturity.

- Some small businesses may stick with the very simple organizational structures because they are not interested in growing to the point where more complicated structures are required.

- The ILC is the time continuum along which an industry is born, grows, matures, declines, and dies.

- There are four stages in the ILC: introduction, growth, maturity, and decline.

EXERCISE

- Interview the owners of three small businesses in your community, each a different type and size. Where would you put each business with respect to the five stages of small business growth? Justify your answer.

1.4 Ethics

LEARNING OBJECTIVES

- Define ethics.

- Explain business ethics.

- Describe small business ethics.

- Understand why a small business should have an ethics policy.

Ethics are about doing the right thing. They are about well-based standards of right and wrong that prescribe what humans ought to do—usually in terms of rights, obligations, benefits to society, fairness, or specific virtues.Manuel Velasquez et al., “What Is Ethics?,” Santa Clara University: Markula Center for Applied Ethics, 2010, accessed October 7, 2011, www.scu.edu/ethics/practicing/decision/whatisethics.html. They serve as guidelines for making decisions about how to behave in specific situations; they also guide us in evaluating the actions of others.Daniel J. Brown and Jonathan B. King, “Small Business Ethics: Influences and Perceptions,” Journal of Small Business Management 11, no. 8 (1982): 11–18. Hopefully, they will provide us with a good understanding of how to react to situations long before those situations occur.

What Ethics Are Not

It is important to understand what ethics are not.“A Framework for Thinking Ethically,” Santa Clara University: Markula Center for Applied Ethics, 2009, accessed October 7, 2011, www.scu.edu/ethics/practicing/decision/framework.html.

- Ethics are not the same as our feelings. Our feelings are not always accurate indicators about a particular action being unethical (e.g., taking a long lunch or spending too much personal time on the Internet while at work). We all develop defense mechanisms to protect ourselves, so we may not feel badly about a particular unethical act. Some people may actually feel good about behaving unethically.

- Ethics are not the same as religion. Most religions champion high ethical standards, but not everyone is religious. Ethics apply to everyone.

- Ethics are not necessarily synonymous with the law. There will be instances in which ethical behavior and the law are the same (e.g., in the cases of murder, discrimination, whistleblower protection, and fraud). Such instances are illustrative of a good legal system. There will, however, be times when the law takes a different path than ethics—the result being ethical corruption that serves only the interests of small groups.

- Ethics are not about following cultural norms. Following cultural norms works only for ethical cultures. Although most cultures probably like to see themselves as ethical, all societies have been and will be plagued with norms that are unethical (e.g., slavery in the United States prior to the Civil War and sweatshops in developing countries).

- Ethics are not synonymous with science. Science cannot tell us what to do. The sciences can provide us with insights into human behavior, but ethics provides the reasons and the guidance for what we should do.

- Ethics are not the same as values. Although values are essential to ethics, the two are not synonymous. Values are enduring beliefs that a given behavior or outcome is desirable or good.Milton Rokeach, The Nature of Human Values (New York: Free Press, 1973), 5, as cited in Wayne D. Hoyer and Deborah J. MacInnis, Consumer Behavior (Boston: Houghton Mifflin, 2001), 416. They create internal judgments that will determine how a person actually behaves. Ethics determine which values should be pursued and which should not.Jeff Landauer and Joseph Rowlands, “Values,” Importance of Philosophy, 2001, accessed October 7, 2011, www.importanceofphilosophy.com/Ethics_Values.html.

Why Ethics Are Important

Ethics are important because they provide structure and stabilization for society. They help us to understand what is good and bad, and this helps us to choose between right and wrong actions. Without ethics, our actions would be “random and aimless, with no way to work toward a goal because there would be no way to pick between a limitless number of goals.”Jeff Landauer and Joseph Rowlands, “Values,” Importance of Philosophy, 2001, accessed October 7, 2011, www.importanceofphilosophy.com/Ethics_Values.html. Ethics do not provide easy answers to hard questions, but they do provide a framework within which to seek the answers.

Business Ethics

Business ethics is applying the virtues and discipline of ethics to business behavior. They set the standard for how your business is conducted and define the value system of how you operate in the marketplace and within your business.“Business Ethics,” Small Business Notes, accessed October 7, 2011, www.smallbusinessnotes.com/operating/leadership/ethics.html. They are relevant to any and all aspects of business conduct: workplace issues, product and brand, corporate wrongdoing, professional ethics, and global business ethics. They apply equally to the individual who works for the company and to the company itself because all ethical and unethical business behavior eventually finds its way to the bottom line. It is almost a certainty that someone will encounter an ethical dilemma at some point in his or her professional life.

Video Link 1.1

Business Ethics in the Twenty-First Century

A PBS documentary about business ethics and social responsibility.

Do Business Ethics Pay?

Asking whether business ethics pay may be the wrong question to ask. Behaving ethically should happen because it is the right thing to do. However, companies large and small are in the business of making money, so the question is not an unreasonable one. Good ethics carry many benefits, not the least of which is financial good health. Companies that “outbehave” the competition ethically will also tend to outperform them financially.Richard McGill Murphy, “Why Doing Good Is Good for Business,” CNNMoney.com, February 2, 2010, accessed October 7, 2011, money.cnn.com/2010/02/01/news/companies/dov_seidman_lrn.fortune. According to an Institute of Business Ethics report, companies with a code of conduct generated significantly more economic value added and market value added than those companies without a code, experienced less price to earnings volatility, and showed a 50 percent increase in average return on capital employed.Simon Webley and Elise More, “Does Business Ethics Pay?,” Institute of Business Ethics, 2003, accessed October 7, 2011, www.ibe.org.uk/userfiles/doesbusethicpaysumm.pdf.

Business ethics also pay in other ways that will improve the workplace climate and, ultimately, positively impact the bottom line. They can “reduce incidents of corruption, fraud, and other malpractices; enhance the trust of customers, suppliers and contractors; enhance the credibility of buyers and salespersons; and enhance the loyalty and goodwill of employees, shareholders and customers.”Simon Webley and Elise More, “Does Business Ethics Pay?,” Institute of Business Ethics, 2003, accessed October 7, 2011, www.ibe.org.uk/userfiles/doesbusethicpaysumm.pdf.

The Costs of Unethical Business Conduct

By contrast, the costs of unethical business behavior can be staggering. Some of the costs include the loss of physical assets, increased security, the loss of customers, the loss of employees, the loss of reputation, legal costs, the loss of investor confidence, regulatory intrusion, and the costs of bankruptcy. According to a report by the Josephson Institute,“The Hidden Costs of Unethical Behavior,” Josephson Institute, 2004, accessed October 7, 2011, josephsoninstitute.org/pdf/Report_HiddenCostsUnethicalBehavior.pdf. unethical business behavior has an adverse impact on sales, stock prices, productivity, the performance of the highly skilled employees, efficiency, communication, and employee retention and recruiting plus the risks from scandal and employee fraud.

The costs of employee theft are particularly daunting. An estimated 75 percent of employees steal from the workplace, and most do so repeatedly. One third of all US corporate bankruptcies are caused directly by employee theft; US companies lose nearly $400 billion per year in lost productivity due to “time theft” or loafing; and an estimated 20 percent of every dollar earned by a US company is lost to employee theft.Terrence Shulman, “Employee Theft Statistics,” Employee Theft Solutions, 2007, accessed October 7, 2011, www.employeetheftsolutions.com. Office supplies, money, and merchandise are the most frequently stolen items.Leslie Taylor, “Four in 10 Managers Have Fired Employees for Theft,” Inc., September 1, 2006, accessed October 7, 2011, www.inc.com/news/articles/200609/theft.html?partner=rss. Employee theft may be even more of a concern to small businesses because many small businesses operate so close to the margin. It has been estimated that theft by small business employees totals nearly $40 billion each year.Mary Paulsell, “The Problem of Employee Theft,” MissouriBusiness.net, October 10, 2007, accessed October 7, 2011, www.missouribusiness.net/sbtdc/docs/problem_employee_theft.asp.

Small Business Ethics

In business, it is common for there to be conflicts between business success and ethical behavior. When faced with an ethical dilemma, the decision may be unduly influenced by profits and legality. This challenge is particularly acute for small business owners because they are so much closer to the employees and the customers. The results of ethical decisions will be felt more immediately by the entire company.Karen E. Klein, “Making the Case for Business Ethics,” Bloomberg BusinessWeek, April 26, 2010, accessed October 7, 2011, www.BusinessWeek.com/smallbiz/content/dec2008/sb20081230_999118.htm.

Small-business owners will find themselves confronted more often with ethical choices because of the decision-making autonomy that they have; there is no need to answer to a large number of employees, corporate management, or a corporate board. The ethical choices that are made will likely impact a far greater number of people than will the ethical decisions of individual employees. Many business decisions will pose ethical challenges—examples being whether to use inferior materials to produce products because of competition with larger businesses, employee and workplace problems, product quality and pricing, legal problems, and government regulatory concerns.Jeffrey S. Hornsby et al., “The Ethical Perceptions of Small Business Owners: A Factor Analytic Study,” Journal of Small Business Management 32 (1994): 9–16, adapted. The pressure to make an unethical choice on behalf of the small business can be very powerful, especially when the health and vitality of the business may be at stake.“Business Ethics,” Answers.com, 2001, accessed October 7, 2011, www.answers.com/topic/business-ethics. Fortunately, the chances of an unethical decision being made in a small business are lower because the individual or individuals who are harmed will always be more visible. It is more difficult for the small business owner to be unethical. Ultimately, small business owners will behave in accordance with “their own moral compass, sense of fair play and inclination to deal in good faith.”Jim Blasingame, “Small Business Ethics,” Small Business Advocate, August 13, 2001, accessed October 7, 2011, www.smallbusinessadvocate.com/motivational-minutes/small-business-ethics-22.

According to one study,Daniel J. Brown and Jonathan B. King, “Small Business Ethics: Influences and Perceptions,” Journal of Small Business Management 11, no. 8 (1982): 11–18. small businesses see norms and pressures from the community and peers as having more influence on their ethics than moral or religious principles, the anticipation of rewards, upholding the law, or the fear of punishment. This leads to the conclusion that small business is influenced significantly by the communities in which their businesses are located. Socially responsive behavior is visible and it is “rewarded or sanctioned by local residents through changes in employee morale, performance, and turnover; customer loyalty; and positive interactions with business service professionals, suppliers, local government officials, and business colleagues. These local sanctioning mechanisms [in turn affected] the success of the business.”Terry L. Besser, “Community Involvement and the Perception of Success among Small Business Operators in Small Towns,” Journal of Small Business Management37, no. 4 (1999): 16–29.

Because of this community influence, customer relationships are and must be based on trust and the relatively immediate visibility of ethical behavior. It is perhaps not surprising that people in small business are ranked number one on ethical standards ahead of physicians, people in big business, and government officials.Daniel J. Brown and Jonathan B. King, “Small Business Ethics: Influences and Perceptions,” Journal of Small Business Management 11, no. 8 (1982): 11–18.

Developing an Ethics Policy

The small business owner is in a unique position to set the ethical tone for the business. Employees will follow the lead of the owner when executing their duties and tending to their responsibilities, so it is critical that the owner establish an ethical work environment.“Business Ethics,” Answers.com, 2001, accessed October 7, 2011, www.answers.com/topic/business-ethics. Establishing an ethics policy (code of conduct or code of ethics) is an important step in creating that environment. Employees who work in companies with active ethics programs; who observe leaders modeling ethical behavior; and who see honesty, respect, and trust applied frequently in the workplace have reported more positive experiences that include the following:Natalie Rhoden, “Ethics in the Workplace,” Articlesbase, November 5, 2008, accessed October 7, 2011, www.articlesbase.com/human-resources-articles/ethics-in-the -workplace-629384.html.

- Less pressure on employees to compromise ethics standards

- Less observed misconduct at work

- Greater willingness to report misconduct

- Greater satisfaction with their organization’s response to misconduct they report

- Greater overall satisfaction with their organizations

- Greater likelihood of “feeling valued” by their organizations

These positive work experiences would be even more notable in small businesses because of the smaller number of employees.

Employee perceptions of their organization’s ethical leadership may well be the most important driver of employee trust and loyalty.Jennifer Schramm, “Perceptions on Ethics,” HR Magazine, November 2004, 176. Having an ethical culture should, therefore, be a top priority for every small business.

Many small business owners may feel that a code of ethics is unnecessary. However, the benefit of having such a code is higher employee morale and commitment, more loyal customers, and a more supportive community. Even the nonemployee small business benefits. A code of ethics puts your business in a more positive, proactive light, and it spells out to customers and employees what behavior is and is not appropriate.Jeff Wuorio, “Put It in Writing: Your Business Has Ethics,” Microsoft Small Business, 2011, accessed October 7, 2011, www.microsoft.com/business/en-us/resources/management/leadership-training/put-it-in-writing-your-business-has-ethics.aspx ?fbid=WTbndqFrlli.

There is no recipe for developing an ethics policy. Its development may involve no one other than the small business owner, but it should involve several people. The contents should be specific to the values, goals, and culture of each company, and it should be “a central guide and reference for users in support of day-to-day decision making. It is meant to clarify an organization’s mission, values, and principles, linking them with the standards of professional conduct.”“Why Have a Code of Conduct,” Ethics Resource Center, May 29, 2009, accessed October 7, 2011, www.ethics.org/resource/why-have-code-conduct. Small-business owners must decide what will make the most sense for their companies. Jeff Wuorio offered the following eight guidelines:Jeff Wuorio, “Put It in Writing: Your Business Has Ethics,” Microsoft Small Business, 2011, accessed October 7, 2011, www.microsoft.com/business/en-us/resources/management/leadership-training/put-it-in-writing-your-business-has-ethics.aspx ?fbid=WTbndqFrlli.

- Focus on business practices and specific issues. The content of one company’s code of ethics will differ from that of another.

- Tailor it to fit your business. One size does not fit all. Make sure your code of ethics reflects the values and mission of your company.

- Include employees in developing a code of ethics. A mandate from the small business owner will not be effective. Get input from your employees whenever possible. They will be more accepting of the ethics policy.

- Train your people to be ethical. The extent and nature of employee education and training will depend on the size of the small business. Even the smallest business, however, will benefit from some ethics training.

- Post your code of ethics internally and set up a reporting system. Employees need a way to let someone know about ethics violations. Both an open-door policy and an anonymous reporting system will be helpful.

- Consider appointing a compliance person. This would probably not be appropriate for the very small businesses. However, it would be worth considering if the business has fifty or more employees. Having someone to whom employees can report suspected ethical problems would make things much simpler.

- Follow up on any ethics violations you uncover. Make sure that everyone understands the ramifications of ethics policy violations. Include an appeals process. If a small business owner fails to act on ethics violations, employees will not take the policy seriously.

- Live it from the top down. The small business owner must walk the talk. No one should appear to be above the code of ethics. Good role modeling is critical.

The actual development of a code of ethics can be done by starting from scratch, hiring a consultant, or customizing a code from another organization. Before making a choice, it would be worth doing some research. A good place to start would be www.conductcode.com, a website that looks at codes of conduct from a practitioner approach. A search of the Internet will provide examples of codes of ethics, but there is a bias toward larger companies, so small business owners will have to pick and choose what will be best suited to their respective companies.

Ethical Behavior Survey

The Ethics Resource Center conducted a survey of employees at large and small businesses and found the following:

- Fifty-six percent of the employees had witnessed misconduct by other employees that violated the firm’s ethics standards or policies or the law.

- Fifty-four percent of the employees who had witnessed misconduct believed that reporting the misconduct would not lead to corrective action.

- Forty-two percent of the employees who had witnessed misconduct reported it. The percentage rose to 61 percent for employees whose employers have a well-implemented ethics and compliance program.

- Thirty-six percent of the employees who had witnessed misconduct but did not report it cited fear of retaliation as their reason for not reporting it.Reported in Jeff Madura, Introduction to Business (St. Paul, MN: Paradigm Publishing, 2010), 52.

KEY TAKEAWAYS

- Ethics are about doing the right thing. They are about standards that help us decide between right and wrong. They are not the same as our feelings, religion, the law, cultural norms, science, or values.

- Ethics are important because they provide structure and stabilization for society.

- Business ethics are about applying the virtues and discipline of ethics to business behavior. They set the standard for how your business is conducted and define the value system of how you operate in the marketplace and within your business.

- Companies that “outbehave” the competition ethically tend to outperform them financially.

- Ethical behavior in business improves the workplace climate and will ultimately improve the bottom line. The cost of unethical behavior can be staggering.

- Small-business owners have the opportunity to set the ethical tone for their companies. Modeling ethical behavior is key. The community and peers heavily influence small business ethics.

- Establishing an ethics policy is critical for creating an ethical work environment. The contents of the policy should be specific to the values, goals, and culture of each company. One size does not fit all.

EXERCISES

- MaryAnn’s marketing team just presented a “Less Sugar” ad campaign to the cereal brand manager for three of her brands. The packages shouted “75% LESS SUGAR” in large and colorful type so that it would catch the parent’s eye and increase sales. With all the recent attention about childhood obesity, the company thought that parents would purchase the cereal to help their children attain and keep a healthy weight. A side-by-side comparison of the less-sugar and the high-sugar versions of the cereals, however, revealed that the carbohydrate content of the cereals was essentially the same. At best, the less-sugar version had only ten fewer calories per bowl. It offered no weight-loss advantage. The brand manager correctly concluded that the marketing campaign was unethical.J. Brooke Hamilton III, “Case Example 1: ‘Less Sugar’ Marketing,” Operationalizing Ethics in Business Settings, 2009, accessed June 1, 2012, ethicsops.com/LessSugarMarketingCase.php. Was the campaign illegal? What should the cereal brand manager do?

- An office supplies business with fifty employees has been doing well, but lately there have been suspicions by some of the employees. No names are known, but it is known that merchandise has been disappearing without explanation, and expensive gifts have been accepted from some vendors. The owner thinks it is time to create and implement a code of ethics. She has asked you for advice. You told her that it would be important to involve the employees in the development of the code, but you committed to do two things for her in preparation for that involvement: (1) search the Internet for a code of ethics that could be tailored to her needs and (2) prepare a preliminary list of topics that should be included in the code. She thanked you and asked that you submit your ideas within the week. She reminded you that her business is small, so a code of ethics for a large corporation would not be suitable.

1.5 The Three Threads

LEARNING OBJECTIVES

- Define customer value and explain why it is important to small business competitiveness.

- Define digital technology and explain its role in small business competitiveness.

- Define e-business and explain why e-business is important to small businesses.

- Define e-commerce and explain why e-commerce should be integrated into small businesses.

There are three threads that flow throughout this text: customer value, cash flow, and digital resources and e-environments. These threads can be likened to the human body. Cash flow is the circulatory system, without which there can be no life. Digital technology and e-business are the internal organs that carry out daily processes. E-commerce is the sensory system that enables business to observe and interact with the external environment. Customer value is overall health. These threads must figure prominently in all small business decision making. Although they are necessary but not sufficient conditions for small business survival, the chances for survival will be reduced significantly if they are not used.

Customer Value

In 1916, Nathan Hanwerker was an employee at one of the largest restaurants on Coney Island—but he had a vision. Using his wife’s recipe, he and his wife opened a hot dog stand. He believed that the combination of a better tasting hot dog and the nickel price, half that of his competitors, was his recipe for success. He was wrong. Unfortunately for Nathan, Upton Sinclair’s book The Jungle a decade before had made the public suspicious of low-cost meat products. Nathan discovered that his initial business model was not working. Customers valued taste and cost, but they also valued the quality of a safe product. To convince customers that his hot dogs were safe, he secured several doctors’ smocks and had people wear them. The sight of “doctors” consuming Nathan’s hot dogs gave customers the extra value that they needed. It was all about the perception of quality. If doctors were eating the hot dogs, they must be OK. Today there are over 20,000 outlets serving Nathan’s hot dogs.John A. Jakle and Keith A. Sculle, Fast Food (Baltimore: Johns Hopkins University Press, 1999), 163–64.

In principle, customer value is a very simple concept. It is the difference between the benefits that a customer receives from a product or a service and the costs associated with obtaining that product or service. Total customer benefit refers to the perceived monetary value of the bundle of economic, functional, and psychological benefits customers expect from a product or a service because of the products, services, personnel, and images involved. Total customer cost, the perceived bundle of costs that customers expect to occur when they evaluate, obtain, use, and dispose of the product or use the service, include monetary, time, energy, and psychological costs.Philip Kotler and Kevin Lane, Marketing Management (Upper Saddle River, NJ: Pearson Prentice-Hall, 2009), 121. In short, it is all about what customers get and what they have to give up.

In reality, the creation of customer value will always be a challenge—particularly because it almost always needs to be defined on the customer’s terms.H. Whitelock, “How to Create Customer Value,” eZine Articles, March 16, 2007, accessed October 7, 2011, ezinearticles.com/?How-to-Create-Customer-Value &id=491697. Nonetheless, “the number one goal of business should be to ‘maximize customer value and strive to increase value continuously.’ If a firm maximizes customer value, relative to competitors, success will follow. If a firm’s products are viewed as conveying little customer value, the firm will eventually atrophy and fail.”Earl Nauman, Creating Customer Value: The Path to Sustainable Competitive Advantage (New York: Free Press, 1995), 16. This will certainly be true for the small business that is much closer to its customers than the large business.

The small business owner needs to be thinking about customer value every day: what is offered now, how it can be made better, and what the competition is doing that is offering more value. It is not easy, but it is essential. All business decisions will add to or detract from the value that can be offered to the customer. If your product or service is perceived to offer more value than that of the competition, you will get the sale. Otherwise, you will not get the sale.

Cash Flow

Revenue is vanity…margin is sanity…cash is king.

Unknown.

Most people would define success with respect to profits or sales. This misses a critical point. The survival of a firm hinges not so much on sales or profits, although these are vitally important, as it does on the firm’s ability to meet its financial obligations. A firm must learn to properly manage its cash flow, defined as the money coming into and flowing from a business because cash is more than king. It is a firm’s lifeblood. As the North Dakota Small Business Development Center put it, “Failure to properly plan cash flow is one of the leading causes for small business failure.”“Why Is Cash Flow So Important?,” North Dakota Small Business Development Center, 2005, accessed October 7, 2011, www.ndsbdc.org/faq/default.asp?ID=323.

An understanding of cash flow requires some understanding of accounting systems. There are two types: cash based and accrual. In a cash-based accounting system, sales are recorded when you receive the money. This type of system is really meant for small firms with sales totaling less than $1 million. Accrual accounting systems, by contrast, are systems that focus on measuring profits. They assume that when you make a sale, you are paid at that point. However, almost all firms make sales on credit, and they also make purchases on credit. Add in that sales are seldom constant, and you begin to see how easily and often cash inflows and outflows can fall out of sync. This can reduce a firm’s liquidity, which is its ability to pay its bills. Envision the following scenario: A firm generates tremendous sales by using easy credit terms: 10 percent down and one year to pay the remaining 90 percent. However, the firm purchases its materials under tight credit terms. In an accrual accounting system, this might appear to produce significant profits. However, the firm may be unable to pay its bills and salaries. In this type of situation, the firm, particularly the small firm, can easily fail.

There are other reasons why cash flow is critically important. Firms need to have the money to buy new materials or expand. In addition, firms should have cash available to meet unexpected contingencies or investment opportunities.

Cash-flow management requires a future-focused orientation. You have to anticipate your future cash inflows and outflows and what actions you may need to take to preserve your liquidity. Today, even the nonemployee firm can begin this process with simple spreadsheet software. Slightly larger firms could opt for the user-dedicated software. In either case, cash-flow analysis requires the owner to focus on the future and to develop effective planning skills.

Cash-flow management also involves activities such as expense control, receivables management, inventory control, and developing a close relationship with commercial lenders. The small business owner needs to think about these things every day. Their requirements may tax many small business operators, but they are essential skills.

- Expense control requires owners or operators to think in terms of constantly seeking out efficiencies and cost-reduction strategies.

- Receivables management forces owners to think about how to walk the delicate balance of offering customers the benefits of credit while trying to receive the payments as quickly as possible. They can use technology and e-business to expedite the cash inflow.

- Effective inventory control translates into an understanding of the ABC classification system (sorting inventory by volume and value), and determining order quantities and reorder points. Inevitably, any serious consideration of inventory management leads one to the study of “lean” philosophies. Lean inventory management refers to approaches that focus on minimizing inventory by eliminating all sources of waste. Lean inventory management inevitably leads its practitioners to adopt a new process-driven view of the firm and its operations.

- Lastly, attention to cash-flow management recognizes that there may well be periods when cash outflows will exceed cash inflows. You may have to use commercial loans, equity loans(pledging physical assets for cash), and/or lines of credit. These may not be offered by a lender at the drop of a hat. Small-business owners need to anticipate these cash shortfalls and should already have an established working relationship with a commercial lender.

A small business needs to be profitable over the long term if it is going to survive. However, this becomes problematic if the business is not generating enough cash to pay its way on a daily basis.Barry Minnery, “Don’t Question the Importance of Cash Flow: Making a Profit Is the Goal but Day-to-Day Costs Must Be Met in Order to Keep a Business Afloat,” The Independent.com, May 28, 2010, accessed October 7, 2011, http://www.articlesezinedaily.com/dont-question-the-importance-of-cash-flow/. Cash flow can be a sign of the health—or pending death—of a small business. The need to ensure that cash is properly managed must therefore be a top priority for the business.Barry Minnery, “Don’t Question the Importance of Cash Flow: Making a Profit Is the Goal but Day-to-Day Costs Must Be Met in Order to Keep a Business Afloat,” The Independent.com, May 28, 2010, accessed October 7, 2011, http://www.articlesezinedaily.com/dont-question-the-importance-of-cash-flow/. This is why cash-flow implications must be considered when making all business decisions. Everything will be a cash flow factor one way or the other. Fred Adler, a venture capitalist, could not have said it better when he said, “Happiness is a positive cash flow.”Fred Adler, QuotationsBook.com, accessed October 7, 2011, quotationsbook.com/quote/18235.

Digital Technology and the E-Environment

Digital technology and the e-environment continue to change the way small and large businesses operate. Digital technology refers to a broad spectrum of computer hardware, software, and information retrieval and manipulation systems. The e-environment is a catchall term that includes e-business and e-commerce. The Internet in particular has had a powerful impact on the demands of customers, suppliers, and vendors, each of whom is ready—perhaps even expects—to do business 24/7.

Why Digital Technology?

With the advent of the personal computer and the Internet, small firms may be able to compete on a more equal footing with larger firms through their intelligent use of digital technologies. It would be impossible to list all the types of software that can enhance small business operations, so the focus will be on the major types of aids.

Today, even the smallest of firms can acquire a complete accounting system at a reasonable price. These packages can be tailored for specific industries and are designed to grow with the company. They not only generate standard accounting and financial reports but also assist with management decision making. Information about accounting software for small businesses is easily available on the Internet.

Small-business operations have also benefited greatly from affordable software that can handle forecasting, inventory control and purchasing, customer relations, and shipping and receiving. In fact, the software has advanced to the point where a small firm can cost-effectively possess its own enterprise resource planning (ERP) system. Only a few years ago, ERP systems were out of reach for all but the largest firms. ERP systems integrate multiple business functions, from purchasing to sales, billings, accounting records, and payroll (see Figure 1.2 “Broad Schematic of an ERP System”). These advances now give small firms the capability and opportunity to participate in global supply chains, thus broadening their customer base.

Figure 1.2 Broad Schematic of an ERP System

Touch screen computers, smartphones, or iPads can bring a new level of sophistication to data entry and manipulation and communications. Smartphones can boost productivity, especially when out of the office.Christopher Elliott, “5 Ways Smartphones & Servers Boost Productivity,” Microsoft Small Business Center, 2010, accessed October 7, 2011, www.microsoft.com/business/en-us/resources/technology/communications/smartphones-and-business -productivity.aspx?fbid=WTbndqFrlli. It is predicted that the iPad will change how we build business relationships, particularly with respect to connecting with prospects in a more meaningful way.Brent Leary, “The iPad: Changing How We Build Business Relationships,” Inc., accessed October 7, 2011, www.inc.com/hardware/articles/201005/leary.html. Inventory control may soon be revolutionized by a technology known as radio-frequency identity devices (RFIDs). These small devices enable the tracking of inventory items. These same devices may change retailing by curtailing time at checkout and eliminating pilferage.Kevin Bonsor, Candace Keener, and Wesley Fenlon, “How RFID Works,” HowStuffWorks.com, accessed October 23, 2011, electronics.howstuffworks.com/gadgets/high-tech-gadgets/rfid.htm.

Using Smartphones in Your Business

Lloyd’s Construction is a 100-person demolition and carting firm in Eagan, Minnesota. This small, family-owned business is not your typical candidate for a firm that exploits cutting-edge technology. At the suggestion of the president’s 17-year-old daughter, the firm switched to a smartphone system that allows for integrated data entry and communication. This system allowed the firm to reduce its routing and fuel costs by as much as 30 percent. The firm was also able to further reduce accounting and dispatch costs. On an investment of $50,000, the firm estimated that it saved $1 million in 2007.Jonathan Blum, “Running an Entire Business from Smartphones: Mobile Software Helps Track Equipment, Accounts—and Employee Lunch Breaks,” CNNMoney.com, March 12, 2008, accessed October 7, 2011, money.cnn.com/2008/03/11/smbusiness/mobile_phone_software.fsb/index.htm.

All these technologies, and others, are within the reach of the small business, but careful analysis must determine which technologies are best suited for a company. Given the speed of digital technology development, this analysis is something that should be conducted on a frequent basis. It is in the best interest of every small business to introduce digital technologies into the business as quickly as is practical and affordable. There should always be an interest in doing things better and faster. Through technology, a small business owner will be able to do so much more: grow the business (if desired), work smarter, attract more customers, enhance customer service, and stay ahead of the competition.“Technology: Your Roadmap to Small Business Success,” Intel, 2009, accessed October 7, 2011, www.intel.com/content/www/us/en/world-ahead/world-ahead -small-business-success-article.html.

The smaller the business, the more efficient it needs to be. Digital technology can help. Digital technologies, with their relatively low cost, ease of implementation, and power, can offer small businesses the rare opportunity to compete with larger rivals. If smaller firms are able to fully use the capabilities of these technologies along with exploiting their faster decision-making cycle, they can be the ones that secure competitive advantage.

Why E-business?

E-business is a term that is often used interchangeably with e-commerce, but this is not accurate. E-business uses the Internet and online technologies to create operational efficiencies, thereby increasing value to the customer.Kelly Wright, “E-Commerce vs. E-Business,” Supply Chain Resource Cooperative, November 27, 2002, accessed October 7, 2011, scm.ncsu.edu/public/lessons/less021127.html. Its focus is internal—for example, online inventory control systems; accounting systems; procurement processes; supplier performance evaluation processes; tools to increase supply chain efficiency; processing requests for machine repairs; and the integration of planning, sourcing, and manufacturing. Critical business systems are connected to critical constituencies—customers, vendors, and suppliers—via the Internet, extranets, and intranets.Elias M. Awad, Electronic Commerce: From Vision to Fulfillment (Upper Saddle River, NJ: Pearson Education, 2004), 4. No revenue is generated, but “e-business applications turn into e-commerce precisely when an exchange of value occurs.”Kenneth C. Laudon and Carol Guercio Traver, E-commerce: Business, Technology, Society (Upper Saddle River, NJ: Pearson Prentice Hall, 2007), 11.

E-business processes should be introduced wherever there is a process that is currently working OK but is costing unnecessary time and money to implement via paper. This would certainly apply to the small business that finds itself drowning in paperwork. Small businesses should always consider that e-business processes could improve their operational and cost efficiencies overall, so thinking about e-business implications should be part of many decisions. E-business can work for any small business “because it involves the whole business cycle for production, procurement, distribution, sales, payment, fulfillment, restocking and marketing. It’s about relationships with customers, employees, suppliers and distributors. It involves support services like banks, lawyers, accountants and government agencies.”“Making Money on the Internet,” BizBeginners.biz, accessed October 23, 2011, bizbeginners.biz/e_business.html. The way you do business and your future profitability will be affected by e-business. Converting your current business into e-business may require some redesign and reshaping, depending on the size of your company. However, e-business integration should be seen as an essential element in the efforts of a small business to increase its agility in responding to customer, market, and other strategic requirements.William M. Ulrich, “E-Business Integration: A Framework for Success,” Software Magazine, August 2001, accessed October 7, 2011, findarticles.com/p/articles/mi_m0SMG/is_4_21/ai_78436110.

Why E-commerce?

E-commerce, the marketing, selling, and buying of goods and services online, is a subset of e-business. It generates revenue, whereas other areas of e-business do not. E-commerce has experienced extraordinary and rapid growth and will continue to grab more market share.Heather Green, “US Ecommerce Growth to Pick up in 2010, But Hit Mature Stride,” Bloomberg BusinessWeek, February 2, 2009, accessed June 1, 2012, http://www.businessweek.com/the_thread/the_thread_05272011/blogspotting/archives/2009/02/us_ecommerce_gr.html.

In a survey of 400 small businesses, each with fewer than 100 employees, it was reported that the Internet had significantly improved growth and profitability while helping to reduce costs. Some businesses even indicated that they rely on the Internet to survive. Interestingly, the survey participants themselves took advantage of e-commerce to purchase computers and office technology online (54 percent), capital equipment and supplies (48 percent), and office furnishings (21 percent); one third bought inventory for online resale, and 59 percent purchased other business-related goods online.Robyn Greenspan, “Net Drives Profits to Small Biz,” ClickZ, March 25, 2004, accessed October 7, 2011, www.clickz.com/clickz/stats/1719145/net-drives-profits-small-biz. E-commerce offers many benefits to small businesses, including the following:“E-commerce: Small Businesses Become Virtual Giants on the Internet,” SCORE, accessed October 7, 2011, www.score.org/system/files/become_a_virtual_giant.pdf.

- Lower business costs. It may not be necessary to maintain as much physical space and staff.

- Greater accessibility. Customers can shop when they want to.

- The ability to provide customized service. Like Amazon.com, companies can address their customers on a personal level by recognizing and greeting repeat shoppers.